Customs Compliance

Whether you are importing or exporting, the goods, products and/or services will cross a border somewhere in its transition. All goods, products and/or services are subject to regulations also known as tariffs barriers (TB) that are ‘’negotiated between over 160 countries at the World Trade Organization (WTO) which is the only global international organization dealing with the rules of trade between nations’’. Its headquarters is located in Geneva, Switzerland. These customs tariffs dictated by different countries, which can lead to a real nightmare for whomever is going through the process and is not familiar with the laws that regulates the goods, products and/or services and the country where the goods, products and/or services are exported/imported to.

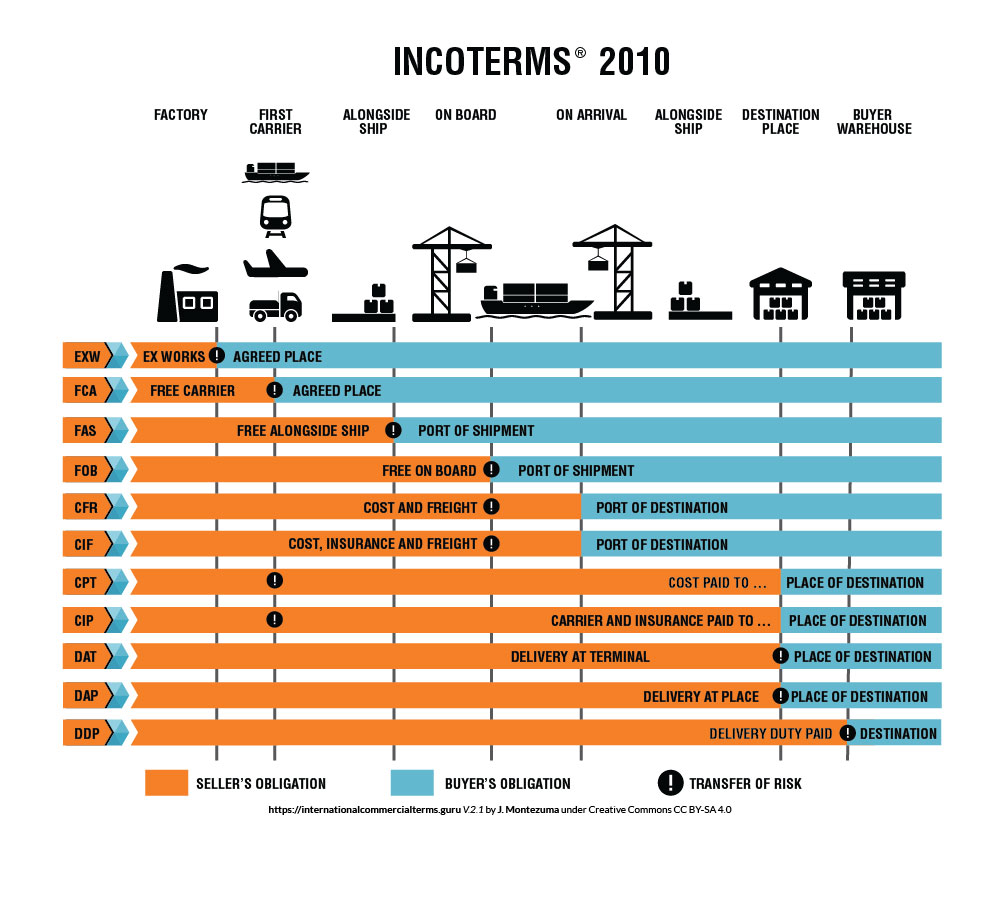

We, at TapionExIm, are working with the latest version of the Guide to Incoterms® rules 2010 published by International Chamber of Commerce (ICC) – We Are The World Business Organization®. In 1936, the ICC fist defined the INternational COmmerce Terminology (INCO Terms). There are 11 Incoterms divided in 4 groups. What are rules the Incoterms done in the International Transportation, Supply Chain & Logistics Management industry (Air Cargo, Road Stations, Rail Transport, Freight Forwarding, Freight Shipping Businesses, Freight Management and Maritime Freight Lines)? Essentially, the INCOTERMS are used for communicate and delimit tasks, cost and risk linked with transportation and delivery of goods. We collaborate with our partners who are working in the international trade sector, such as, Exporters, Importers, Freight Forwarders, Lawyers, Insurers, Practioners, Traders, Transporters, Governments, Banks and Consultants.

Unless, I am not mistaken to confirm to the Canadian Exporters/Importers that ’’ Freight incoterms (International Commercial Terms) are the standard contract term used in sales contracts with importing/exporting to define responsibility and liability for shipment of the goods. In plain English – how far along the process will the supplier ensure that the goods are moved, and at what point does the buyer take over the shipment process 1 .

Source: © Copyright 2010 J. Montezuma V2.1, INCOTERMS® 2010, https://internationalcommercialterms.guru/ https://www.freightos.com/freight-resources/incoterms-plain-english-freight-shipping-guide/“

Avoid penalties or inconvenience at the border. Most of the time, there will be a financial impact in not meeting customs regulations (TB). Yes there can be a fine in some cases (although rare), but most importantly is the financial impact of delaying the arrival of the goods in the country. For example, the imported goods might be targeted for a local market that will not be able to resell the products. Your client may miss a good window of opportunity, especially when the goods imported are classified as seasonal products. This is just an example. There are lots of other situations where delaying the entry of the goods can have a financial impact.

Regardless, everyone wants to avoid this kind of situation. Just the complexity of dealing with the process is enough to give the average human being a headache and keeping them awake at night.

All countries have their own regulations to comply with and the non-compliance consequences vary greatly. It requires therefore an extensive analysis by someone mastering the ins-and-outs of the country being dealt with.

First of all, as an example, exporting to the United-States of America from Canada requires the exporter to get a certification to the C-TPAT (Customs-Trade Partnership Against Terrorism). On the other hand, the Certificate of Phytosanitary that apply to the Canadian Importers of these vegetal products or farms products shipped by the Exporters from foreign countries, both above-mentioned certifications are the examples for non-tariffs barriers (NTB). Lastly, there are fees which apply to them and the seller/exporter is responsible to comply with the regulations such as a range of tariff and non-tariff barriers that the importing country has put in place to protect the local producers in their domestic markets from external competition in order to stimulate local production by creating good sustainable jobs for workers and competitiveness of small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SBEs) and large enterprises.

The purpose is to facilitate when required, in a safe manner, the goods movement to the US and as well to others foreign trade markets, and it is essential that Canadian Exporters strictly comply to C-TPAT regulations. And we, at TapionExIm, are fully qualified in C-TPAT certification.

No matter which products and/or services and which country you are exporting to or importing from, TapionExIm is here to take this off your shoulder and help you succeed.

https://www.freightos.com/freight-resources/incoterms-plain-english-freight-shipping-guide/”